TDS UScellular (NYSE: USM)在其2024年第三季度财报电话会议上报告了重大的战略发展,包括频谱货币化的进展和用户指标的改善。该公司提高了盈利前景,并正在完成与T-Mobile的交易。尽管服务收入下降,但UScellular调整后的EBITDA和OIBDA有所增加。这也是CFO Doug Chambers的最后一次电话会议,他对公司的财务纪律和战略计划充满信心。

TDS UScellular公司已敲定出售60亿美元颈部IT解决方案,积极影响自由现金流。

调整后的EBITDA和OIBDA盈利前景上调,而TDS电信保持强劲的指引。

用户指标有所改善,零售净亏损减少,后付费ARPU增加。

升职Nal策略提高了客户留存率,减少了客户流失。

收购T-Mobile的交易预计将在2025年中期完成,监管机构已经提交了相关文件。

服务收入下降了2%,但成本优化使调整后的OIBDA提高了1%,调整后的EBITDA增加了3%。

该公司报告称,由于运营原因,毫米波许可证的减值损失为1.36亿美元最终的挑战。

TDS UScellular将服务收入的财务预期收窄至29.5亿至30亿美元,资本支出为2.5亿至6亿美元。

该公司的目标是获得120万个可销售的光纤服务地址和60%的光纤服务覆盖率。

TDS仍然专注于完成交易、优化资本和扩大光纤服务能力,以实现未来的增长。

第三季度的季度收入同比下降了55%。

据报执照减值损失达1.36亿美元。

通过有机增长和潜在收购扩大铁塔投资组合的长期前景乐观。

MVNO计划正处于一个国家的推广阶段它是美国最大的5G供应商,预计很快就会全面推出。

TDS电信的宽带部门显示,20%的客户使用gig服务有助于提高ARPU。

第三季度的服务收入下降了2%。

宽带的增长比预期的要慢,尽管对未来有一些积极的早期指标。

Doug Chambers澄清说,由于净经营亏损和结转利息,与频谱销售相关的现金税将会降低。

关于频谱销售收益使用的讨论将集中在减少债务、加速光纤部署和股东回报等方面。

人工智能对运营的影响尽管手机升级率有所下降,但客户服务的效率仍有希望。

Tower投资组合的策略是在co .之前提高托管费率nsidering收购。

TDS的MVNO发射正处于试验阶段,预计将全面商业化。

TDS UScellular继续应对市场挑战,同时利用战略举措来加强其财务和运营绩效。该公司专注于保持财务纪律和优化资本配置,准备利用其战略交易和光纤服务扩张来推动未来的增长。

为了补充对TDS UScellular(纽约证券交易所代码:USM)第三季度收益的全面概述,让我们深入了解InvestingPro提供的一些关键财务指标和见解。

USM的市值为49.4亿美元,反映了其在电信行业的重要地位。尽管面临诸多挑战,但该公司的股票表现出了非凡的弹性,过去六个月的总回报率高达68.59%。这与公司在财报电话会议中提到的战略发展和前景改善相一致。

InvestingPro Tips强调USM的流动资产超过其短期债务,表明其强大的流动性地位。这种财务稳定性对该公司的战略举措至关重要,包括T-Mobile交易和光纤服务扩张。

另一个InvestingPro提示指出,分析师预测该公司今年将实现盈利。这一预测与盈利电话会议中讨论的改善后的盈利能力前景一致,其中UScellular提高了其EBITDA和OIBDA指导。

截至2024年第三季度,该公司过去12个月的收入为37.99亿美元,毛利率为56.96%。虽然文章提到服务收入下降了2%,但强劲的毛利率表明有效的成本管理,这反映在调整后的OIBDA和EBITDA数据中。

值得注意的是,根据InvestingPro Tips, USM的息税前估值倍数很高。这可能表明投资者对公司的未来前景持乐观态度,可能是受到正在进行的战略举措和预期完成T-Mobile交易的推动。

对于寻求更全面分析的投资者,InvestingPro提供了额外的提示和指标,可以更深入地了解USM的财务状况和市场地位。

接线员:谢谢您的等待。我叫曼迪普,今天我是你的接线员。现在,我想欢迎大家参加TDS UScellular 2024年第三季度运营业绩电话会议。所有的线条都在我身上,以防止任何背景噪音。演讲者提交后,将有一个问答环节。[操作说明]谢谢。现在我想把电话交给负责企业关系的副总裁科琳·汤普森。你可以开始了。

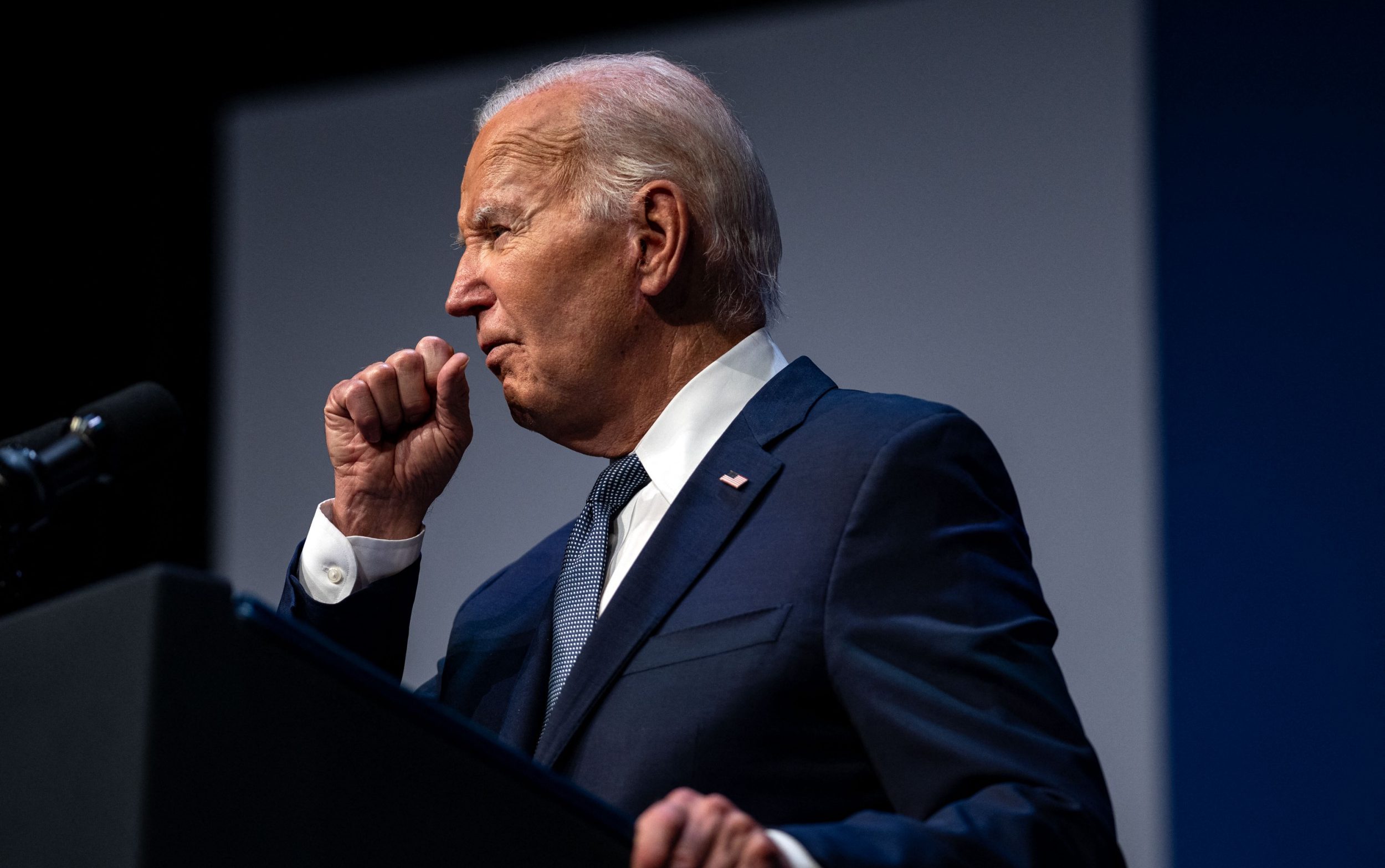

科琳·汤普森:早上好,感谢大家的到来。我们想让你们都知道,我们准备了今天上午的演讲,你可以在TDS和UScellular网站的投资者关系部分找到。今天和我一起准备发言的是TDS执行副总裁兼首席财务官Vicki Villacrez;从UScellular, LT Therivel,总裁兼首席执行官;Doug Chambers,执行副总裁、首席财务官兼财务主管;TDS Telecom的高级财务副总裁兼首席财务官Michelle Brukwicki。这次电话会议同时在TDS和UScellular投资者关系网站上进行网络直播。请参阅本电话会议中提到的幻灯片,包括非公认会计准则对账。我们为调整后的折旧及摊销前营业收入(OIBDA)和调整后的息税、折旧及摊销前收益(EBITDA)提供指导,以突出UScellular无线合作伙伴关系的贡献。如幻灯片2所示,演示文稿中列出的信息以及本次电话会议中讨论的信息包含有关预期未来事件和财务结果的陈述,这些陈述具有前瞻性,并受到风险和不确定性的影响。请查阅我们新闻稿中的安全港段落以及我们提交给SEC的文件中的扩展版本。说到这里,我现在把电话交给薇姬·维拉雷斯。维姬?

Vicki Villacrez:好的。谢谢你,科琳,大家早上好。在我们开始之前,我想承认最近席卷新墨西哥州鲁伊多索的飓风和大火造成的破坏性影响。我们的心与所有受到影响和遭受损失的人同在。我要感谢我们的团队,特别是在我们的客户和社区最需要我们的时候,他们齐心协力为所有受影响的社区提供支持和帮助。谢谢你!当我谈到结果时,我想强调的是,我们又执行了一个季度的优先事项,这是我们在今年制定的。由于LT将更详细地介绍,UScellular在与T-Mobile拟议交易中未包括的部分频谱货币化方面取得了不错的进展。这些交易确实凸显了这些许可证的巨大价值和需求。我们考察了整个企业,进行了其他几笔交易,这将有助于集中我们的资源,进一步优化我们的足迹。首先,我们oneNeck IT解决方案的销售在9月初结束。出售oneNeck是一笔自由现金流。我们还就剥离TDS电信某些非战略性资产达成了协议,这些资产预计将于今年晚些时候完成。至于结果,我对我们第三季度的表现感到满意。这两个业务部门都专注于实现其财务目标,导致UScellular提高了调整后EBITDA和调整后OIBDA的盈利前景,TDS电信重申了其指导方针。本季度结束时,我们的现金和流动性状况稳定。连续每个季度,我们的债务与ebitda比率在整个2024年都有所改善。两家公司在继续投资网络的同时,都在继续产生正的自由现金流。我们很高兴看到美联储在9月中旬降息,因为这将略微降低我们的利率成本。我们将继续通过以历史低利率发行的长期债务组合来管理我们的资产负债表。我们将继续保持合理的杠杆和充足的流动性,所有这些都为我们进入第四季度提供了灵活性,并期待执行我们的运营目标和长期战略目标。在转电话之前,我们最近宣布Michelle Brukwicki将在12月离开TDS,她在TDS工作了17年。我谨代表公司感谢她的领导,并祝她在接下来的工作中一切顺利。随着Michelle即将离职,现任TDS电信财务分析和战略规划副总裁的Kris Bothfeld将接任TDS电信财务副总裁兼首席财务官一职。米歇尔和克里斯将在下个月过渡。我还要感谢我们所有的同事在这个充满活力的时代所付出的辛勤工作。现在,LT,我把它交给你。

LT Therivel: Thanks, Vicki. Good morning, everyone. I want to just briefly echo Vicki’s sentiments regarding Hurricane Helene. I also want to pass along my sincere thanks to our network and operations teams that have worked tirelessly to restore our network and support our customers. Our operations have recovered, but it’s going to take a long time for that area to fully recover and everyone that’s affected is certainly in our thoughts. With that, let’s pivot to the materials. I’m going to take us to Page 5, and that covers some recent highlights. First, following our announcement back in May, the process to sell our Wireless operations and select spectrum to T-Mobile is proceeding as expected. As you may have seen, we filed our public interest statement with the FCC in September and we believe we’re on track for a mid-2025 closing. We remain confident that the transaction with T-Mobile is the best long-term solution for our customers as it gives them the long-term benefits of greater scale and a more competitive network. The T-Mobile transaction will also provide us with an additional long-term Tower tenant and a strengthened Tower business. If you recall, we began reporting separate Wireless and Tower segment information last quarter, and we plan to continue to provide this detail going forward up to the expected close of the T-Mobile transaction. Also, as we talked about in our May announcement, after the proposed T-Mobile transaction, we’ll be left with approximately 70% of our spectrum. We’ve been running a process to opportunistically monetize that spectrum, and in October, we entered into agreements with multiple carriers to sell certain portions of those retained licenses in exchange for aggregate proceeds of over $1 billion. Slide 6 shows our progress on the monetization and it includes the sale of our 850 megahertz spectrum and a portion of our AWS and PCS spectrum to Verizon (NYSE:VZ), as well as the sale of small portions of our CBRS, C-Band, and 700 megahertz spectrum to two other smaller network mobile operators. These license sale transactions are subject to regulatory approval and they’re also contingent on the close of our proposed transaction with T-Mobile. We’re really pleased that we worked with multiple buyers, large and small, and that we were able to enter into agreements to realize substantial value for these licenses and that was well in excess of our book value. Doug will be providing more details on the expected gain and the tax impacts associated with these license transactions. Now, we continue to work on opportunities for monetization of the remaining spectrum, but as this is an ongoing process, I won’t be able to share any additional details today, but I will provide more updates as they become available. Now, let’s talk about the quarter. The team remains highly focused on balancing improving subscriber momentum with delivering strong operational and financial performance, and you can see that in our results. As discussed last quarter, earlier this year, we made promotional changes that have improved our subscriber trajectory while executing cost reduction initiatives that have enabled us to maintain strong profitability. We’ve continued to see the momentum from these changes in the third quarter and we improved retail net losses by 20,000 subscribers year-over-year. In addition, we’ve been committed to caring for our existing customers, and that includes conducting US Days multiple times throughout 2024, and as a reminder, US Days are periods where highly attractive promotional offers are made available to our existing customers. We believe this focus in our existing customers through US Days and through other promotional investments has contributed to improved post-pay handset churn for each of the first three quarters of 2024. We plan on continue [Technical Difficulty] reward our existing customers through US Days and other promotional offers in the fourth quarter. For the industry as a whole, while the pool of available subscribers was down again in the quarter on a year-over-year basis, our share of growth ads increased and that allowed us to keep postpaid handset growth ads flat. This is particularly noteworthy in the context of our deal announcement. postpaid handset net losses improved by 10,000 year-over-year due to an improvement in churn, again, partially attributable to our focus on rewarding our existing customers with attractive promotions and continuing to deliver a strong network experience. We’ve also seen nice improvement in prepaid due to our competitive pricing and promotional strategies, including our compelling multi-line pricing, which began in May of this year, and I’m really pleased with our improved subscriber momentum, particularly given that we’ve seen no let-up in competitive intensity and that’s from either the large mobile network operators or the cable wireless players. Our postpaid ARPU also increased 2%, partially due to customers realizing the value of our higher-tier plans. We had 54% of our postpaid handset customers on the top two tier plans compared to 46% a year ago, and given the cost pressures associated with those continued promotional investments, as well as inflation and the ongoing deployment of 5G, the teams have been doing an excellent job managing costs, with expenses down year-over-year in all major categories. And I’m really proud of our efforts to balance subscriber growth with financial discipline and that’s enabled us to raise our full year profitability guidance this quarter. Turning to the network, we currently have over 80% of our data traffic already handled by sites that have been upgraded with low-band 5G and that provides strong 5G coverage in our footprint. And so, consistent with our 5G network investments in 2024, future 5G network investments will predominantly be dedicated to the deployment of mid-band spectrum, and that’s going to enhance 5G speed and capacity. And we noted previously that we expected capital expenditures for the full year to trend toward the lower end of our guidance range and this quarter, we lowered our capital guidance to reflect that. Before I turn the call over to Doug, I want to congratulate the team for UScellular being ranked number one in the North Central Region J.D. Power Study, reinforcing that our ongoing 5G network investments are resulting in a strong customer experience. And as all these results demonstrate, we’re executing on the strategic initiatives that we’ve laid out for the business earlier this year and I believe we’re well positioned heading into the busy holiday season. I want to thank the team for their hard work and I’ll now turn the call over to Doug.

Doug Chambers: Thanks, LT. Good morning. Before discussing quarterly results, I want to provide some additional details on the proposed licensed sales transaction that LT previously highlighted and some broader impacts to our license portfolio. Subject to closing the pending T-Mobile transaction and regulatory approvals of the license transactions, we expect proceeds at just over $0.0 billion on the licensed sale transactions announced in October, and highlighted on Slide 6. These licenses have a net book value of approximately $590 million, and after transaction fees and transaction accounting adjustments, we expect to recognize a gain on the licensed sales upon their respective close dates. Further, we expect total cash taxes related to these recently announced spectrum transactions to be in the range of $200 million to $250 million for UScellular and $150 million to $200 million for TDS. This is in addition to estimated cash taxes on the pending T-Mobile transaction, which we expect to be in the range of $225 million to $325 million for UScellular and $150 million to $250 million for TDS. Additionally, as a result of our efforts to monetize spectrum assets not subject to the securities purchase agreement with T-Mobile, UScellular was required to review and update the groupings of licenses for units of accounting for purposes of impairment testing. As a result of this review, our millimeter wave licenses in the 28-gigahertz, 37-gigahertz and 39-gigahertz bands were identified as a separate unit of accounting. Due in part to industry-wide challenges related to operationalizing this millimeter wave spectrum, UScellular estimated the fair value of these licenses to be less than their corresponding carrying value, and this was the primary driver of UScellular recording a loss on impairment of licenses of $136 million or $102 million net of tax in the third quarter of 2024. After recognition of the loss on impairment of licenses, the carrying value of our millimeter wave spectrum, not subject to the T-Mobile transaction is $161 million. Now let’s review the financial results starting on Slide 10. Service revenues declined 2% driven by declines in the average subscriber base, partially offset by a higher postpaid ARPU as LT discussed previously. System operations expense decreased 2% as cost optimization actions, including the shutdown of our CDMA network in the first quarter of 2024, more than offset increases that resulted from our ongoing mid-band 5G deployment. Further, selling general and administrative expenses decreased 3% and excluding the impact of strategic alternative expenses included in this expense category decreased 5% due to decreases in sales-related expenses, bad debts expense, as well as decreases across various other general and administrative categories due to cost optimization initiatives. This led to an improvement in adjusted operating income before depreciation and amortization of 1% and an improvement in adjusted EBITDA, which incorporates the earnings from our equity method investments, along with interest and dividend income of 3%. Slides 11 and 12 present the separate results for the Wireless and Tower segment. Tower revenue from third parties increased 1% in the third quarter as co-location growth has slowed relative to recent years and was also impacted by defections, including Sprint-related defections. As we have discussed on prior calls, the Wireless industry has moderated capital expenditures beginning in 2023 and we experienced a corresponding slowdown in new tenant and amendment activity, which is impacting Tower revenue growth rates in 2024. Again, we remain bullish on the long-term outlook for our Towers business and the long-term capacity needs of the industry that will drive demand for towers. Further, the pending transaction with T-Mobile, which is subject to regulatory approval and their commitment to lease 2015 incremental towers for an initial term of 15 years is expected to significantly increase third-party Tower revenues. Briefly on free cash flow, on a year-to-date basis through September 30th, due to improved profitability and moderated capital expenditures, we generated free cash flow of $331 million, a $94 million increase over the prior year. This has allowed us to repay $163 million of debt in the first nine months of 2024 and an additional $40 million of debt in October, which has further improved our leverage ratios. Our 2024 financial guide is on Slide 13. Given this late stage of the year, relative to the guidance we initially issued in February 2024, we are narrowing the ranges of our guidance for service revenues to $2.95 billion to $3.0 billion and capital expenditures from $250 million to $600 million. Further, we are narrowing and raising the ranges of our guidance for adjusted income before depreciation and amortization to $800 million to $875 million and adjusted EBITDA to $970 million to $1.045 billion, reflecting the successful cost management results that we expect to achieve in the full year 2024. I will now turn the call over to Michelle Brukwicki.

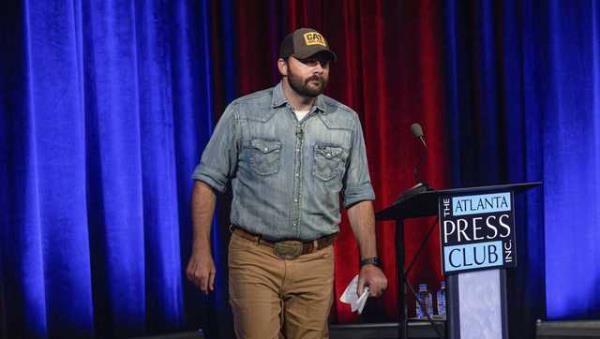

Michelle Brukwicki: Thank you, Doug, and good morning, everyone. Let’s turn to Slide 15 for our third quarter highlight. This quarter, we reached an important milestone in that 50% of our service addresses are now served by fiber. We continue to grow our footprint, expanding service addresses 9% year-over-year. The team delivered 32,000 new marketable fiber addresses in the quarter, bringing our year-to-date total to 87,000, making progress on our 125,000 marketable fiber service address goal for the year. Our fiber broadband strategy is continuing to deliver good results, contributing to a 2% increase in total operating revenue and a 21% increase in adjusted EBITDA for the quarter. We also grew total residential broadband connections 4% year-over-year. Our fiber strategy is extremely important. Fiber in our expansion and incumbent markets is providing growth, helping to overcome industry-wide competitive pressures facing our copper and cable markets. Moving to Slide 16, you can see where we are on our longer-term scorecard. We are targeting 1.2 million marketable fiber service addresses. We ended the quarter with 886,000. This reflects progress in growing fiber through our expansion markets, as well as fibering up our incumbent markets. We are also targeting 60% of our total service addresses to be served by fiber. We ended the quarter with 50%. And finally, we are expecting to offer speeds of 1-gig or higher to at least 80% of our footprint. We finished the quarter with 74% at gig speeds. These goals do not include fiber deployments that will be completed through the enhanced A-CAM program. Therefore, these goals will increase once we add in E-ACAM fiber addresses. We’re working closely with the FCC to finalize our precise service address obligations. Our original offer required building to approximately 270,000 addresses, but we expect the final obligation to be lower. We will provide updated goals when we have more certainty on the final address reconciliation. On Slide 17, you can see we are growing our footprint, with a 9% increase in total service addresses year-over-year. As shown on the right side of the slide, we see increased demand for higher broadband speeds, with 79% of our customers taking 100 megabits per second or greater, up from 75% a year ago. We continue to increase the availability of gig plus speeds and customer take rates of these speeds are growing, with 20% of our customer base on 1-gig or higher at the end of the quarter. Turning to Slide 18, we had 2,700 residential broadband net adds in the quarter, which contributed to 4% growth in residential broadband connections year-over-year. As we deliver new fiber service addresses, our teams are marketing and selling into those addresses. This quarter, we added 7,600 residential broadband net adds in our expansion markets. While this is providing growth, the pace of net adds has been slower than expected. We remain focused on driving up penetrations in our new expansion markets. Specifically, we’ve been working to increase the number of door-to-door sales reps, including augmenting our internal staff with external resources. Leading indicators are showing improvement in our sales. Looking at the big picture, we are confident in the fundamentals of our fiber program and still targeting approximately 40% broadband penetration once markets hit a steady state. In addition, these markets are operating efficiently and contributing to both revenue and adjusted EBITDA growth. Our expansion markets are more cost-effective than our business cases expected and we’re seeing that fiber markets are the most efficient networks to run. Now, moving on to our incumbent ILEC markets. Where we have upgraded our network from copper to fiber, we’ve been able to effectively defend and compete. We had positive fiber broadband net adds in the quarter, which did not fully offset net losses in our copper areas. With support from the enhanced A-CAM program, we will get even more fiber into our ILEC over the next few years, which will help us defend these markets. In our cable markets, consistent with the industry, we experienced net broadband losses, primarily due to LECs upgrading and fiber overbuilders increasing their presence in our markets. To mitigate these impacts, we continue to promote our strong product, capable of delivering gig speeds using DOCSIS 3.1. We also strategically overbuild our networks with fiber in certain areas, and we put fiber in all new greenfield builds. In addition, we implement strategies to attract and save customers to mitigate market-specific competitive challenges. Now, a couple more comments on net adds. We continued to see impacts from two discrete items that we also mentioned in the second quarter. First, we experienced additional ACP disconnects this quarter, 600 in ILEC and 500 in cable. Second, we had an additional 1,000 cable net losses this quarter due to the wildfire in Ruidoso, New Mexico, that occurred in June. Now, turning to the middle graph, average residential revenue per connection increased 5%. This was due primarily to price increases. With increases in broadband connections and revenue per user, we saw 5% growth in residential revenues. Specifically, expansion markets delivered $29 million of residential revenues in the quarter, compared to $20 million a year ago. As expected, commercial revenues decreased 4% in the quarter as we continue to decommission our CLEC markets. Lastly, wholesale revenues decreased 3% as customers migrate to lower-cost products. On Slide 19, you can see our quarterly performance. Operating revenues were up 2% in the quarter as the growth in residential revenues was partially offset by the decline in commercial and wholesale revenues. As our fiber connections and revenues grow, coupled with a 4% decrease in cash expenses for the quarter, we are seeing nice growth in adjusted EBITDA, up 21%. Capital expenditures were $78 million in the quarter, down 55% from last year, as planned. Slide 20 shows our 2024 guidance, which is unchanged from last quarter. In closing, I want to thank all of the TDS telecom associates for their energy and passion as they care for our customers and communities. As Vicki mentioned, this is my last earnings call at TDS. It has been my privilege to work with so many talented people during my time here. Thank you all. I’m proud of what we have accomplished and I believe TDS telecom has a bright future and is in good hands with Kris Bothfeld as CFO. I will now turn the call back over to Colleen.

科琳·汤普森:好的,接线员。现在我们准备好回答第一个问题了。

接线员:谢谢。我们的第一个问题来自Ric Prentiss和Raymond James的连线。请继续。

Ric Prentiss:谢谢。大家早上好。

Vicki Villacrez:早上好,Ric。

米歇尔:早上好。

Ric Prentiss:谢谢。有几个问题。谢谢你在一些现金税影响上的颜色。我想进一步调查一下T-Mobile和Verizon Spectrum的出售情况。它们是否充分利用了它们是否扣除了不良资产和其他税收收益或者它们是否属于总负债你可能会对它们应用更多收益?

道格·钱伯斯:是的。里克,道格在这个问题上,这是我们预计用于nol和结转利息的净额。这就是为什么TDS的现金税估计会更低的原因,因为它们比UScellular有更多的这些属性、不良资产和利息结转。

里克·普伦蒂斯:有道理。关于Verizon Spectrum的出售,你提到还会有一些费用和其他项目。对于非现金税项目,可能是一对[音频差距]

道格·钱伯斯:这是否也会影响我们在交易结束时所获得的最终收益?

Ric Prentiss:好的。这说得通。那么在交易结束前的租赁,是否意味着T-Mobile交易结束,但你不能立即释放频谱?

道格?钱伯斯:嗯,这意味着T-Mobile的交易可能会结束,我们可能没有获得监管机构对Verizon Spectrum交易的批准。

Ric Prentiss:好的。因为我认为T-Mobile需要一些整合时间来将用户从USM网络迁移到T-Mobile网络。这是一年的时间框架吗?

道格·钱伯斯:没错。在T-Mobile交易结束后,我们有一个长达一年的频谱租约,T-Mobile可能会在这段时间内租用我们的大部分频谱。

里克·普伦蒂斯:有道理。好吧。然后,当你考虑将频谱出售给威瑞森以及这意味着的收益时,显然是哲学上的,假设事情顺利进行,收益的用途是什么?这是不是一种特殊股利思想,如果是特殊股利思想,TDS的思想是什么?这是为了降低杠杆率吗?这是否意味着开始投入更多的资本支出?只是从哲学上知道我们还有很多困难要克服。

Vicki Villacrez:是的。早上好,里克。显然,目前我们的首要任务是完成这些交易。我想再说一遍,我们对这些交易为我们的股东带来的价值感到非常满意,所以我们的首要任务是成功完成交易。当我们接近尾声时,我预计将开始讨论收益的使用,任何收益的使用将由美国移动董事会决定。如果有特别股息和TDS了分享,这将是一个机会TDS做很多事情,包括偿还,偿还债务的潜力,提高影响力,帮助促进和纤维的潜在加速部署程序,我们已经在TDS电信,我们继续看好,很满意的结果,我们看到在我们的市场,以及扩张进入新的市场。TDS可能会考虑向股东回报价值。还有更多。它的早期。再说一次,我们的重点是接近目标。

里克·普伦蒂斯:有道理。在无线方面,还有另一个长期的问题。年初很多人都在担心,会不会出现超级周期,或者iPhone的更新是否会导致设备损失的竞争变化,或者用户池会发生什么?从无线运营商的角度来看,你如何看待人工智能,它可以帮助你做什么,以及它在手机方面可能做什么?

LT Therivel:是的。你好,里克。我想我会给你们两种观点。让我从手机方面开始。现在还没有定论,对吧?因此,我们和其他运营商一样,实际上看到了升级率的下降。人们使用电子设备的时间更长了。我不清楚这是因为他们的消费者仍然认为下一代设备之间的差异相对较小,还是因为他们在等待最新的升级,比如苹果(Apple)的升级,苹果设备的一些人工智能功能已经开始亮相,我认为现在下结论还为时过早。到目前为止,我们当然还没有看到一个超级周期,但我认为现在还为时过早,对吧?现在很多人工智能功能都可以通过软件升级来实现。所以它不会要求那些已经购买了新设备的客户去买一个新的所以我们拭目以待,对吧?我尝试了一些功能。它们非常有趣,我认为它们会随着时间的推移而成熟。所以我认为,从面向消费者的角度来看,人工智能还没有真正改变客户体验,但它可能会改变,我认为它展示了很多前景。我们看到的影响是在我们的运营成本方面。所以我看到了人工智能的很多前景,例如,在护理方面,能够在我们的护理中心提供更好的客户体验,不一定要取代人类,而是为他们提供更及时、次优的服务。以下是我们的建议。我们建议你这样检查顾客。以下是你如何更有效地做到这一点的方法。我们看到的一件事是,由于人工智能的一些能力,我们花在培养护理助理上的时间要少得多。这可以帮助我们避免人员流失。它可以帮助我们从训练。它可以帮助我们更有效率。随着时间的推移,我希望同样的效率水平能够转化为我们的商店,转化为我们的数字体验。因此,从成本的角度来看,我认为我们已经看到了相当多的好处。这在某些情况下反映在我们所看到的每年的费用节省上。我们的护理团队节省了很多费用。他们在管理开支方面做得非常出色,人工智能在这方面提供了帮助。因此,消费者方面,尚无定论。我长期看多。近期的运营效率,我们已经看到了它的好处。

Ric Prentiss:很好。谢谢,每一个人。

LT Therivel:没错。

Vicki Villacrez:谢谢,Ric。接线员,下一个问题。

接线员:下一个问题来自摩根大通的Sebastiano Petti。请继续。

Sebastiano Petti:嗨。谢谢你回答这个问题。简单澄清一下,这里是内务管理。在TDS的新闻发布会上,我想你提出了出售ILEC和电缆资产的分歧。这是否超出了你已经确定的范围,或者是否还有其他可能正在进行的事情?此外,我猜LT,考虑到所有不同交易的RemainCo [ph] Tower投资组合的形式,正如你所考虑的那样,你是否认为USM是一个净收购者,可能是塔或随着时间的推移而扩大的塔投资组合,因为这可能涉及到运营业务,或者更多的是增加租户,为你将在无线生态系统中看到的一些塔的进一步密集化做好准备?

LT Therivel:谢谢,塞巴斯蒂安。

Michelle Brukwicki:谢谢Sebastiano。

LT Therivel: Michelle,你想解决第一个问题吗?

Michelle Brukwicki:是的。嗨,塞巴斯蒂安。是的。薇姬提到的资产剥离,非战略性的电子商务和有线电视资产剥离和我们过去几个月披露的资产剥离是一样的。我们在弗吉尼亚有几个小型的ILEC,我们正在剥离。我们在第二季度宣布了这一消息,我们还在第三季度宣布出售我们在德克萨斯州的有线电视资产。这些就是我们所说的“技术难度”,我们希望在第四季度很快就能完成。

LT Therivel:让我来解决第二个问题。所以让我谈谈我们是如何看待我们目前的Tower投资组合的。第一项工作是提高我们现有资产的托管利率。关于我们的投资组合,一个有趣的事情是,我们几年前才真正开始把它当作一个收入中心,一个利润中心,随着时间的推移,这推动了托管费率的增长。正如Doug所提到的,就资本支出而言,我们现在在无线行业中处于放缓状态,我们已经降低了我们的资本指导,我们的许多竞争对手也这样做了。这反映了我们的Tower业务出现了新的托管机会,新的修改机会等等,因此我们在过去一两年看到了较慢的增长速度。但从长远来看,我们仍然非常看好,因为我们的托管价格大大低于我们的许多竞争对手。我们认为有机会。Tower的投资组合在地理上相对独特。比如,我们有一小部分发射塔在距离我们发射塔1英里,1.5英里,3英里,5英里的范围内。因此,随着时间的推移,随着运营商的密集,我们看到了增加这些托管率的机会,这是我们的首要任务。第二个问题是,当你考虑我们的Tower业务时,我要回答你的问题,当我们考虑收购机会时,这个业务——这是一个规模经营的业务吗?我对伦敦塔的看法是,是的。我们在无线业务上遇到的一个问题,以及为什么我们,为什么我们追求与T-Mobile的交易的一个重要原因是,我们真的在规模上挣扎。无线通讯是一项全国性的业务。很多支出都是全国性的,我们在与大公司的竞争中处于劣势。但在塔楼里却不是这样。塔,你可以在更细粒度的层面上更本地地操作。我们确实认为,我们正处在一个规模上,随着时间的推移,我们可以有效地运营我们的塔投资组合,这也意味着,如果有机会,我们可以在运营费用之下讨论其他塔和其他塔投资组合。所以,对你的问题的长答案是肯定的,但它是肯定的,我们会寻找潜在的机会来扩大投资组合,无论是有机的,建造新的塔楼还是无机的收购投资组合。但现在的估值相当高,对吧?你看看Verizon和Vertical Bridge最近的交易,Shentel卖掉了他们的信号塔,这些都是相当高的估值。因此,我们在把握这些机会时会深思熟虑。我认为这是一个我们长期看好的行业。我们会寻找增长的机会,但我们会寻找一种有意义的增长方式,而且我们不需要花太多钱来收购资产。希望这能让你们了解我们是如何思考的。

Sebastiano Petti:不。这很有帮助。我们对此表示感谢。我想再问一个关于TDS的问题,我知道,上个季度你们宣布了一项MVNO协议或MVNO的推出。当你考虑这个领域时,很明显,大量的注意力集中在融合上,大量的注意力集中在光纤资产上,以及随着时间的推移,它可能会走向何方。考虑到公司,考虑到TDS在光纤方面的努力,光纤路线图和长期目标,首先,很明显,继续独立运营是有意义的。但你会考虑与规模化无线运营商签订独特的协议吗?有一些区域性的ILEC资产。例如,我认为Windstream和AT&T就有协议。但这可能是长期的路线图,也许,尽管你已经支持了MVNO?我的意思是,我想问这个问题的更好方式是,你现在支持MVNO的事实是否妨碍了你可能与规模较大的国家无线运营商达成协议,将你的努力结合起来,提供一个融合的捆绑服务?谢谢。

Michelle Brukwicki:嗨,Sebastiano。让我谈谈我们的MVNO。我们正在把这些都推出去。正如我们过去所提到的,我们正在通过参与国家结核控制中心来开展我们的MVNO。所以我们是工业合作社的一部分。他们与非常强大的合作伙伴合作,这些合作伙伴聚集在一起,整合并为像我们这样参与NCTC的公司提供MVNO机会,所以我们正在利用这一点。NCTC正在合作的无线合作伙伴是一家全国性的5G运营商。所以我们确实可以通过NCTC-MVNO的安排获得这些信息。我们现在正处于启动的过程中。在过去的几个月里,我们一直在进行合作试用,现在我们正在进行客户试用。一旦我们对这些试验的进展感到满意,我们就会进行全面的商业发射,最终在我们的整个足迹上进行发射。这就是我们对MVNO的看法,我们很高兴能以更大的方式推出它,希望很快就能推出。

Sebastiano Petti:再次感谢。

接线员:我们的下一个问题来自Gamco Investors的Sergey Dluzhevskiy。请继续。

谢尔盖·德鲁哲夫斯基:大家早上好。

Vicki Villacrez:早上好。

谢尔盖·德鲁热夫斯基:谢谢你回答问题。我的第一个问题是关于铁塔业务的。因此,我明白,显然该行业正处于较慢的资本支出周期,这影响了新客户的增加和修改。但是在某种程度上,但是我想看看你可以控制的事情,我想在某种程度上,事情进展得很好,还有什么需要改进才能提高你的共址比例?另外,您认为对于贵公司的中期发展轨迹来说,什么样的第三方托管比例是现实的?

LT Therivel:是的。谢谢,谢尔盖。所以,我的意思是,关于经济放缓的一些想法,以及为什么我相信随着时间的推移,我们将看到一个转折点。所以我提到了资本支出的放缓。这是一个在经营无线业务的同时经营电信业务很有帮助的领域,因为你可以清楚地看到推动趋势的因素。对我们来说,推动趋势的是我们已经完成了我们的覆盖范围,不是完成,但我们在覆盖范围建设的道路上走得很好,我们的大部分投资都投向了能力。下一轮大规模投资将由以下两件事之一引发,对吧?第一个将是6G,以及为了实现6G构建而需要带来的任何致密化或新频谱。但第二个,很有趣的是,我相信,是由频谱的缺乏所驱动的,对吧?在不久的将来,运营商获得新频谱的路线图并没有明确的规定。当然,没有我们营销的一些频谱。所以我们——我们有点看好这个等式。但总的来说,如果你是一个运营商,最明显的获得频谱的方式是通过频谱拍卖。美国联邦通信委员会目前没有频谱拍卖权。NDIA提出了一个概念性的路线图,我赞扬他们这样做,它确定了用于分析的频带。但我们作为一个国家分析乐队已经很久了,我们还没能采取行动。我们还没有采取行动,把FCC的频谱权还给他们,所以我公开说过,我认为这是荒谬的。所以现在,政府没有新频谱的路线图。在私人市场上,我认为有人猜测DISH可能会在市场上出售一些频谱。但我认为,最近的公告,无论是在他们获得流动性方面,还是他们从联邦通信委员会获得的延期,都意味着他们的频谱不会出现在市场上。所以你看不到有频谱的运营商。如果你没有新的频谱,你如何满足容量的增加?因为无论我们是否将新的频谱作为一个行业来承担,用户每年使用的数据量仍然会增加20%到25%。它并没有减慢,所以唯一支持它的方法就是致密化。所以随着时间的推移,你会看到更多的构建。我确实认为更多的将集中在小细胞,C-RAN上。它将更多地出现在城市环境中。但即使是在郊区和农村,你也会遇到同样的容量问题,所以运营商需要增加密度。所以他们需要进入新的发射塔和发射塔在他们以前没有去过的地方,我确实认为这将推动我们的发射塔的有吸引力的使用和对我们的发射塔的需求。所以我回到你的问题,我认为我们在哪些方面做得很好?我认为我们现在做得很好,就是与运营商建立协议和关系,我相信我们是运营商的首选基站供应商。我从事这个行业已经很长时间了,通常发射塔供应商和运营商之间的关系有点争议。我们一直在努力确保这种情况不会发生。所以我们有很好的协议,无论是与T-Mobile的MLA,还是与Verizon或AT&T的类似协议。我认为我们已经做好了充分的准备来支持这种增长。另一件令我高兴的事是我们正在努力买回地契。因此,随着时间的推移,大厦业务中不小的支出是房东,土地所有者,实际拥有土地的人,提高了他们土地租赁的利率。因此,我们已经有了一个强有力的项目,我们实际上正在把这个项目投入到明年,试图回购一些土地租赁,并在未来将这些费用控制在一个更容易管理的情况下。所以我认为我们正在把这项业务变成一个有吸引力的利润中心。我认为我们已经做好了充分的准备,可以在未来利用这种增长。谢尔盖,明年我们面临的有趣挑战是,我们必须把facebook变成一家真正独立的公司。当T-Mobile交易完成时,我们需要处于这样一个位置,即铁塔业务可以完全独立运作。当然,它已经独立运作了。但是从开销的角度来看,从系统的角度来看等等,这需要在接下来的六个月左右,六个月,九个月从现在到结束,这是我们运营重点的另一部分。很抱歉在这里进行了冗长的抨击,但希望这能让你了解我们是如何从宏观上看待塔的,同时也能从微观上看待我们看到的机会。

谢尔盖·德鲁哲夫斯基:明白了。谢谢你!我的第二个问题是关于无线合作伙伴关系。因此,在过去几年里,威瑞森一直在购买他们合作伙伴的少数股权。很明显,其中一个更大的交易,是他们交流的一部分。但你的卖家显然在洛杉矶市场拥有更大的少数股权。所以如果你能和我们分享一下你对合伙利益的最新想法,以及什么能让你更接近于将这些资产货币化?

LT Therivel:在过去的几个季度里,我们在战略交易和资产货币化方面有很多事情要做。当然,让这些交易完成,不仅仅是让它们结构化,还要让它们越过球门线,这仍然是我们的重点。我们对这些合作感到满意。它们产生有吸引力的现金流。现金流帮助了我们的无线业务。它帮助我们继续偿还债务。因此,我们并不急于改变与这些伙伴关系的方向。我是说,话虽如此,对吧?作为我们提到的战略评估的一部分,我们对整个业务进行了全面的评估。正如你所看到的,从我们在无线业务上所做的,我们在频谱上所做的,我们如何建立铁塔业务,没有什么神圣不可侵犯的东西,我们确实进行了全面的审视,短期和长期的,关于我们想要的企业是什么样子,我们将继续这样做。因此,如果有一个机会,一个真正好的交易货币化这些合作伙伴关系,我们当然是开放的。但我们不着急。我认为这是我们对他们的表现感到满意的地方。我们对我们在这些伙伴关系中的关系感到满意。他们在经济上很有吸引力。至少现在,我们有很多事情要做,比如提高我们的无线技术难度,以及让大量增量频谱货币化。

谢尔盖·德鲁哲夫斯基:明白了。我的下一个问题是TDS电信公司的米歇尔。你们为你们的家庭宽带客户群提供了很大的分布。在幻灯片中,我想大概有20%是gig +, 10%是600兆,等等。新客户的分销有何不同?所以这是你的整个基础,但是对于你的新客户,可能是上个季度或今年迄今为止,它会是什么样子呢?

Michelle Brukwicki:是的。嗨,谢尔盖。是的。因此,对于我们的新客户,我想说,我们整个基地目前大约有20%的人在提供零工服务。但对于新客户来说,我们大约有40%的客户是通过零工服务来的。这就是为什么我们每个季度都在提升用户的网速,这也推动了ARPU的增长。当然,改善客户体验,满足客户对宽带使用的需求。

谢尔盖·德鲁哲夫斯基:明白了。太好了。我的最后一个问题,回到你的一些评论关于你正在做的事情来改善宽带条件,包括,我猜,你在你的市场中有挨家挨户的销售力量。也许如果你能在这方面提供更多的颜色,还有你正在追求的是什么,除了,我猜,挨家挨户的销售力量,这将提高在未来6个月到12个月内将你的专利转化为付费客户?

Michelle Brukwicki:是的。所以我们——这是我们组织的一大重点。我们有很多人致力于此。所以,是的,去年我们找到了很多服务地址,今年我们也会找到很多,所以我们的首要任务是向这些地址销售,提高我们的宽带普及率。因此,本季度在我们的扩展市场中,我们确实增加了7600个宽带网络用户,这是非常棒的,因为这为我们的宽带网络用户总数提供了增长。但它比我们预期的要慢一些。我们发现,我们需要加强我们的上门销售代表,让更多的人出去销售。我们大约一半的销售额是上门销售的,我们需要更多的资源。因此,我们在过去几个月里一直在为此努力,正如我提到的,我们开始看到一些非常好的领先指标告诉我们,我们的努力正在发挥作用,基于10月份到目前为止我们所看到的情况,我们正走在正确的轨道上。所以我们现在的重点是让这些销售真正增加,并确保我们拥有这样做所需的所有资源。

谢尔盖·德鲁哲夫斯基:明白了。谢谢你!

LT Therivel:谢谢,Sergey。

Michelle Brukwicki:谢谢。

接线员:今天的问答环节到此结束。我现在把话筒交给科琳·汤普森做结束语。

科琳·汤普森:好的。谢谢大家今天抽出时间来。如有任何问题,请联系投资者关系部,祝周末愉快。接线生,我们可以结束通话了。

接线员:谢谢。今天的电话会议到此结束。您现在可以断开连接。

本文是在人工智能的支持下生成的,并由编辑审阅。欲了解更多信息,请参阅我们的T&C。

0